Industry

Mar 28, 2024Chain Insights - Everything You Need to Know About the 2024 Bitcoin Halving Event

Since its inception in 2009, Bitcoin has fundamentally transformed our perspective on how we conduct and navigate the financial landscape. This digital asset stands apart from traditional fiat currency by functioning without a central authority, paving the way for decentralized finance practices.

At the core of Bitcoin's economic framework is the halving process, a unique mechanism embedded within the network’s protocol. This process halves the mining reward for new blocks, serving two primary functions: it acts as a deflationary control by methodically limiting Bitcoin's supply to a maximum of 21 million coins, thereby increasing its scarcity and value over time. This crucial feature ensures Bitcoin retains its worth, addressing the inflation issue prevalent in fiat currencies.

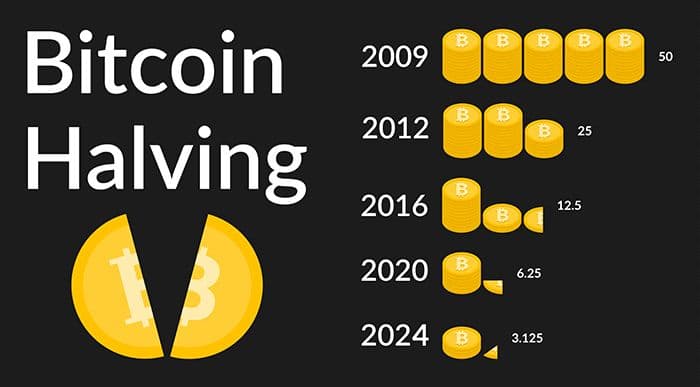

The Bitcoin halving event, occurring every four years, draws widespread attention from the crypto community for its significant impact on miners and investors alike. The next event, expected in April 2024 at block number 740,000, will reduce mining rewards from 6.25 to 3.125 bitcoins. Such events have historically influenced Bitcoin's market dynamics, prompting discussions and speculation regarding their effects on profitability and Bitcoin's valuation.

Miners, essential to the Bitcoin network's maintenance and security, dedicate computational resources to solve cryptographic puzzles, verifying transactions and forming the blockchain's immutable ledger. However, halving events reduce their earnings, posing challenges unless offset by rising Bitcoin prices or improved mining efficiencies. Conversely, for investors, reduced mining rewards mean greater scarcity, potentially enhancing Bitcoin's value.

Bitcoin's operation is based on a proof-of-work system, incentivizing miners with block rewards to ensure network security. The halving process systematically decreases these rewards every 210,000 blocks, reinforcing Bitcoin's deflationary aspect and controlling its supply.

By understanding Bitcoin's halving mechanism, stakeholders and crypto novices can gain insight into its potential economic and market implications, underscoring the cryptocurrency's innovative approach to decentralization and financial transactions.

How Past Halving Events Influenced Bitcoin’s Price and the Mining Community

Past Bitcoin halvings have had a significant impact on both miners' earnings and the cryptocurrency's market value. The inaugural halving in 2012 saw the mining reward decrease from 50 to 25 bitcoins, leading to a substantial price surge from about $13 to over $1,150. The 2016 halving further reduced rewards from 25 to 12.5 bitcoins, with the price escalating from roughly $664 to nearly $17,760, alongside an uptick in mining difficulty. The most recent halving in 2020 halved the reward to 6.25 bitcoins. Although an immediate price surge was not observed, the price eventually soared to around $67,549 the following year.

Market analyses suggest that these trends are a result of two factors: less supply (because of lower mining rewards) and higher demand (as more investors tend to see Bitcoin as a rare asset). However, it's important to remember that many incidents can impact Bitcoin's price, therefore it's not accurate to say that halving events are the sole cause of price changes.

Analyzing the Unique Factors Shaping the 2024 Halving Event

The 2024 Bitcoin halving event is set against a backdrop of evolving economic and technological landscapes. Several key factors distinguish this upcoming milestone from previous ones:

Global Monetary Policies: In the aftermath of the global pandemic, central banks worldwide have been facing a range of challenges, including post-pandemic economic recovery, inflation control, and currency stabilization. These challenges have led to various monetary policy changes, such as lowering interest rates or implementing quantitative easing measures. Such policies can lead to fiat currency fluctuations which may increase the attractiveness of Bitcoin as a potential hedge against inflation and currency devaluation.

In these volatile economic times, Bitcoin's intrinsic feature of digital scarcity becomes increasingly pivotal. Unlike traditional currencies that can be printed at will by central banks, Bitcoin has a finite supply capped at 21 million. This limitation offers a stark contrast to potential inflationary risks associated with traditional currencies and could bolster Bitcoin's value proposition as a 'digital gold'.

Technological Maturation: Over the past decade, blockchain technology, underpinning Bitcoin and other cryptocurrencies, has matured significantly. This maturation is evident in several technological advancements that enhance the overall functionality and utility of Bitcoin.

The first breakthrough lies within transaction speed enhancements. Through Layer 2 solutions like Lightning Network for Bitcoin, transactions can now be processed faster than ever before, thereby improving Bitcoin's potential as a medium of exchange alongside its role as a store of value.

The rise of cross-chain interoperability solutions is another noteworthy development. These solutions allow different blockchain networks to communicate and interact with each other seamlessly. As such, they could significantly extend Bitcoin's reach into various sectors and applications beyond its current scope, potentially boosting its utility and value.

Advancements in Mining Technology

Energy Efficiency: The future of Bitcoin mining lies in innovations that can deliver higher computational power (hash rates) while using less energy. As the 2024 halving event approaches, these advancements will be crucial to mitigating the potential reduction in profitability. The halving will cut miners' rewards by half, hence making the mining process more expensive relative to the rewards received. However, with more efficient mining hardware, miners can continue to maintain, or even increase, their profit margins while consuming less energy. This shift towards more energy-efficient mining technologies is not only beneficial for miners but also contributes to the overall sustainability of the Bitcoin network.

For instance, advances in chip design technology have allowed for the creation of Application-Specific Integrated Circuits (ASICs) that are tailored specifically for Bitcoin mining. These devices are far more efficient than traditional CPUs and GPUs, allowing miners to generate more hashes per unit of energy consumed.

Renewable Energy Sources: The second critical trend shaping the future of Bitcoin mining is the growing emphasis on sustainable practices within the industry. With environmental concerns increasingly at the forefront of global discussions, many mining operations are transitioning to renewable energy sources to power their activities.

Solar and wind power are two primary renewable sources being adopted by miners worldwide. These sources not only help reduce the carbon footprint of Bitcoin mining but also offer cost advantages due to their decreasing prices and potential tax incentives. Additionally, some miners are exploring innovative ways to utilize excess renewable energy for mining operations. For example, certain mining farms located near hydroelectric plants utilize surplus electricity that would otherwise be wasted.

Institutional Investors and Mainstream Adoption

The growing embrace of Bitcoin by both the corporate world and mainstream financial markets signals its increasing significance and potential for widespread use. Corporate treasuries, exemplified by companies like Tesla and MicroStrategy incorporating Bitcoin into their balance sheets, highlight a strategic shift towards diversifying assets with cryptocurrency. This trend may become more prevalent as we approach the 2024 halving. Moreover, the expansion of Bitcoin-centric financial products, including ETFs, is set to draw in a wider pool of institutional and retail investors.

Most importantly, the acceptance of Bitcoin as legal tender by an expanding list of countries and merchants as the years pass, both large and small, underscores its evolving role in the global financial ecosystem, further cementing its legitimacy and utility across different sectors.

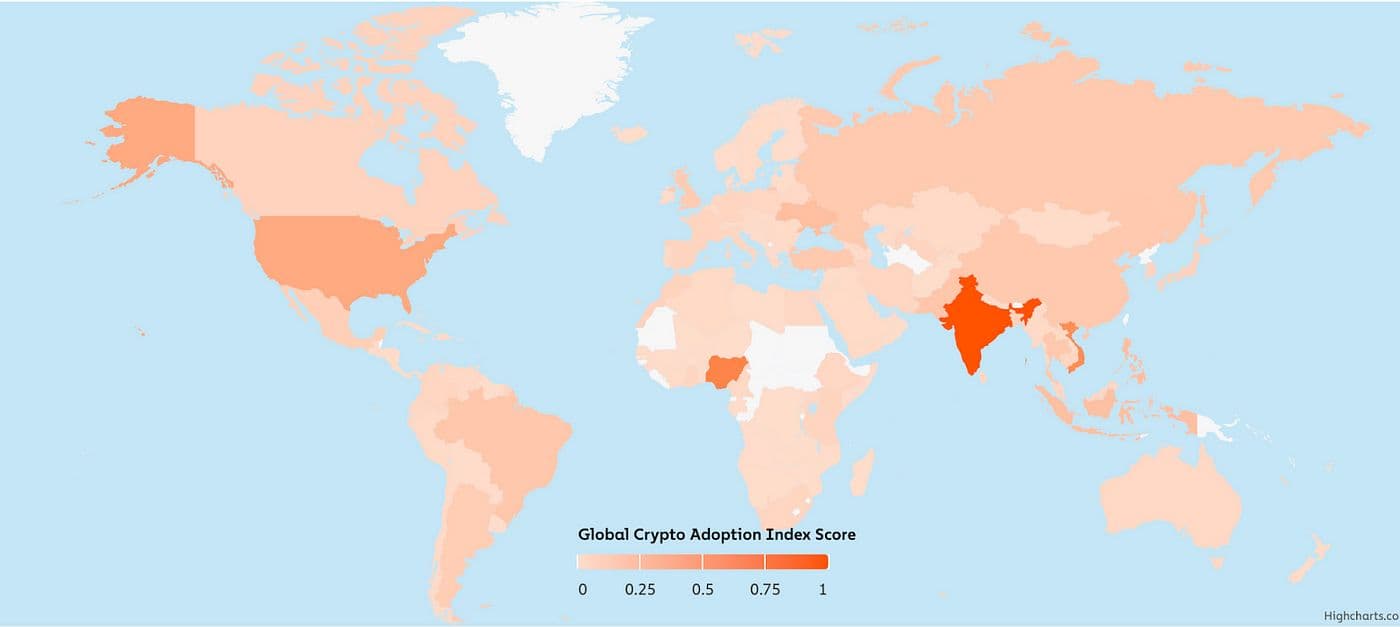

This map by Chainalysis measures crypto adoption using on-chain cryptocurrency value received by a country, on-chain value transferred, number of on-chain cryptocurrency deposits and peer-to-peer exchange trade volume.

Each of these factors plays a role in setting the stage for how the 2024 halving will unfold. The convergence of advancements in mining technology with shifting economic paradigms creates a complex environment where strategic foresight will be crucial for participants in the Bitcoin ecosystem. As miners adapt to new efficiencies and investors respond to macroeconomic signals, vigilance and knowledge is key for navigating the pre-and post-halving periods. To the increasing wave of newcomers exploring online forums and social media communities within the Web3 space, always remember: DYOR (Do Your Own Research)!

Disclaimer: Not Financial Advice

This content is provided for informational and educational purposes only and is not intended as financial, investment, legal, or other professional advice. The information presented does not constitute a recommendation or endorsement to buy or sell any specific securities or engage in any particular investment strategy. The views expressed are those of the author(s) and do not necessarily reflect the official policy or position of any other agency, organization, employer, or company. Readers should conduct their own research and consult with a qualified professional before making any financial decisions. The author(s) and publisher are not responsible for any financial losses or damages resulting from the use of this information.

Sources:

- "Bitcoin Halving 2024 Explained: How It Works & Why Does It Matter." Economic Times, [Link]

- "Bitcoin Halving Really Is Different This Time." CoinDesk, [Link]

About Chain

Chain is a blockchain infrastructure solution company that has been on a mission to enable a smarter and more connected economy since 2014. Chain offers builders in the Web3 industry services that help streamline the process of developing, and maintaining their blockchain infrastructures. Chain implements a SaaS model for its products that addresses the complexities of overall blockchain management. Chain offers a variety of products such as Ledger, Cloud, and NFTs as a service. Companies who choose to utilize Chain’s services will be able to free up resources for developers and cut costs so that clients can focus on their own products and customer experience. Learn more: https://chain.com.

Connect with Chain for the latest updates:

X (Previously Twitter): x.com/Chain

Facebook: facebook.com/Chain

Instagram: instagram.com/Chain

Telegram: t.me/Chain

TikTok: tiktok.com/@Chain

Youtube: youtube.com/Chain

Chain News & Updates

Latest News & Updates

Sign up for the Chain Newsletter - a weekly roundup of new platform features and the latest from the industry.